TL;DR Bitcoin’s market cap may reach $3 trillion post-halving, driven by several important factors.

Opinions on BTC’s future value vary, with optimistic projections as high as $100K, alongside broader industry growth expectations led by figures like Ripple’s CEO.

The Halving’s Possible Impact Bitcoin’s market capitalization recently reached an all-time high of over $1.43 trillion, with the figure currently standing at around $1.32 trillion.

As such, we decided to ask ChatGPT whether BTC’s market cap could hit the $3 trillion milestone once the event takes place.

Additional Factors ChatGPT estimated that the future market dynamics, including institutional adoption, regulatory environments, and macroeconomic elements, will also play a role.

Last but not least, it claimed that a BTC market cap surge to $3 trillion will be possible only if positive investor sentiment is in place.

“While a halving could contribute to an increase in Bitcoin’s price due to reduced supply and historical precedents, predicting a specific market cap like $3 trillion involves substantial speculation.

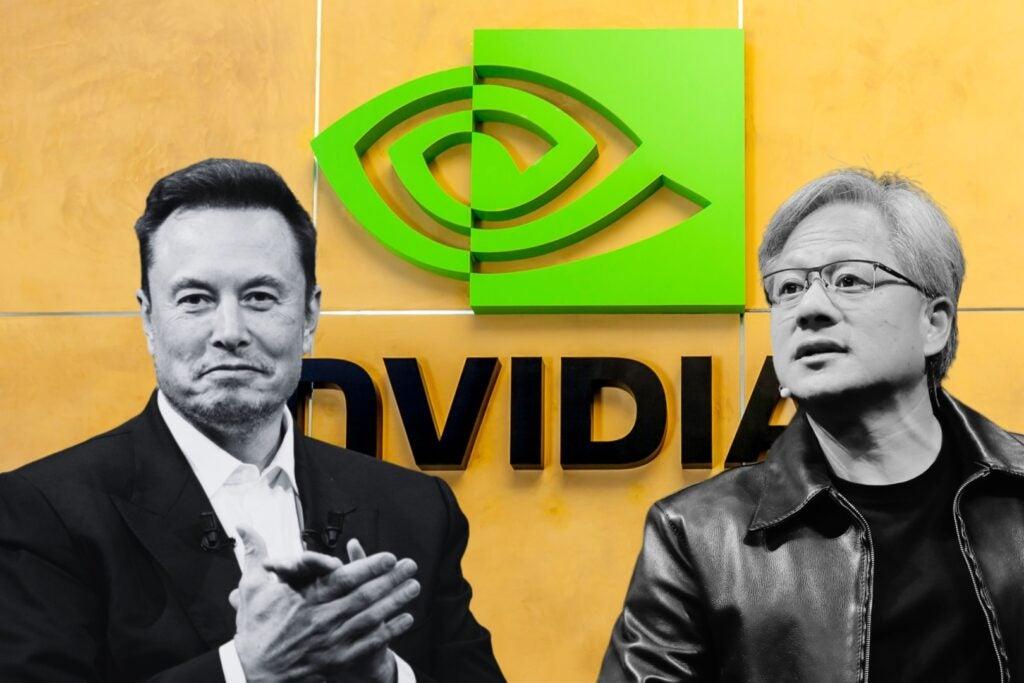

BTC currentluy accounts for approximately 50% of the total share, meaning a future market cap of more than $2.5 trillion (should Garlinghouse’s prediction turn true).

TL;DR.

Due to a number of significant factors, the market capitalization of bitcoin could reach $3 trillion after halving.

Diverse perspectives exist regarding the potential worth of Bitcoin, with some optimistic estimates reaching up to $100,000, as well as more general industry growth expectations spearheaded by individuals such as the CEO of Ripple.

Possible Effects of the Halving.

The market capitalization of bitcoin is currently at about $1.32 trillion, having recently reached an all-time high of over $1.43 trillion.

Due to the impending halving, many industry participants anticipate further gains in the months to come, based on the asset’s impressive price performance over the past month. Therefore, we thought to ask ChatGPT if, after the event, BTC’s market cap could reach the $3 trillion mark.

A scenario like this is possible, but it depends on a number of variables, according to the well-known chatbot. First and foremost, the event’s impact. Even though it has historically signaled the beginning of a Bitcoin bull run, things appear to be different this time around because the price of the cryptocurrency began rising months ahead of the halving.

Marathon Digital CEO Fred Thiel believes that the event-driven rally has already priced in and does not anticipate any notable spikes in the near future.

After the halving, many others, however, are still bullish and expect record highs for the value of Bitcoin. Author of the best-selling book “Rich Dad, Poor Dad,” Robert Kiyosaki, is one example. He forecast that the asset could reach the $100K mark by September of this year.

Extra Elements.

According to ChatGPT’s estimate, institutional adoption, regulatory frameworks, and macroeconomic factors will all have an impact on future market dynamics.

Not to mention, it asserted that positive investor sentiment is a prerequisite for a Bitcoin market capitalization surge to $3 trillion.

Predicting a precise market cap of $3 trillion involves a great deal of speculation, even though a halving might raise the price of Bitcoin due to decreased supply and historical precedents. The chatbot concluded, “Key factors influencing its future value will be technological advancements, market sentiment, economic conditions, and regulatory changes.”.

A Prediction from the CEO of Ripple.

Brad Garlinghouse, the CEO of Ripple, is one individual who recently forecast a promising future for the cryptocurrency market. At some point this year, he thinks the sector’s global market capitalization could surpass $5 trillion.

Currently holding about half of the market, Bitcoin has a potential market capitalization of over $24.5 trillion (assuming Garlinghouse’s forecast comes to pass).