SYDNEY, June 6 (Reuters) – Asian shares slipped on Friday as investors hunkered down for the all-important U.S. payrolls report, while Tesla suffered huge losses on the very public feud between President Donald Trump and billionaire Elon Musk.

Tesla shares (TSLA.O), opens new tab bounced 0.8% in after-hours trading after tumbling a whopping 14% overnight to wipe off $150 billion in market value.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS), opens new tab slipped 0.2% on Friday away from its eight-month peak.

Any unexpected weakness could bring the next U.S. rate cut forward and trigger a huge rally in Treasuries.

U.S. crude futures slipped 0.4% to $63.12 a barrel but were up 3.8% for the week.

SYDNEY, June 6 (Reuters)—As investors braced for the crucial U.S. election, Asian stocks fell on Friday. S. payrolls report, and Tesla’s massive losses were caused by the highly publicized conflict between billionaire Elon Musk and President Donald Trump.

Markets are cautious about a negative surprise in the monthly payrolls print that is due later today due to a run of weak economic data this week. This would increase concerns about stagflation and put more pressure on the Federal Reserve to quickly loosen policy.

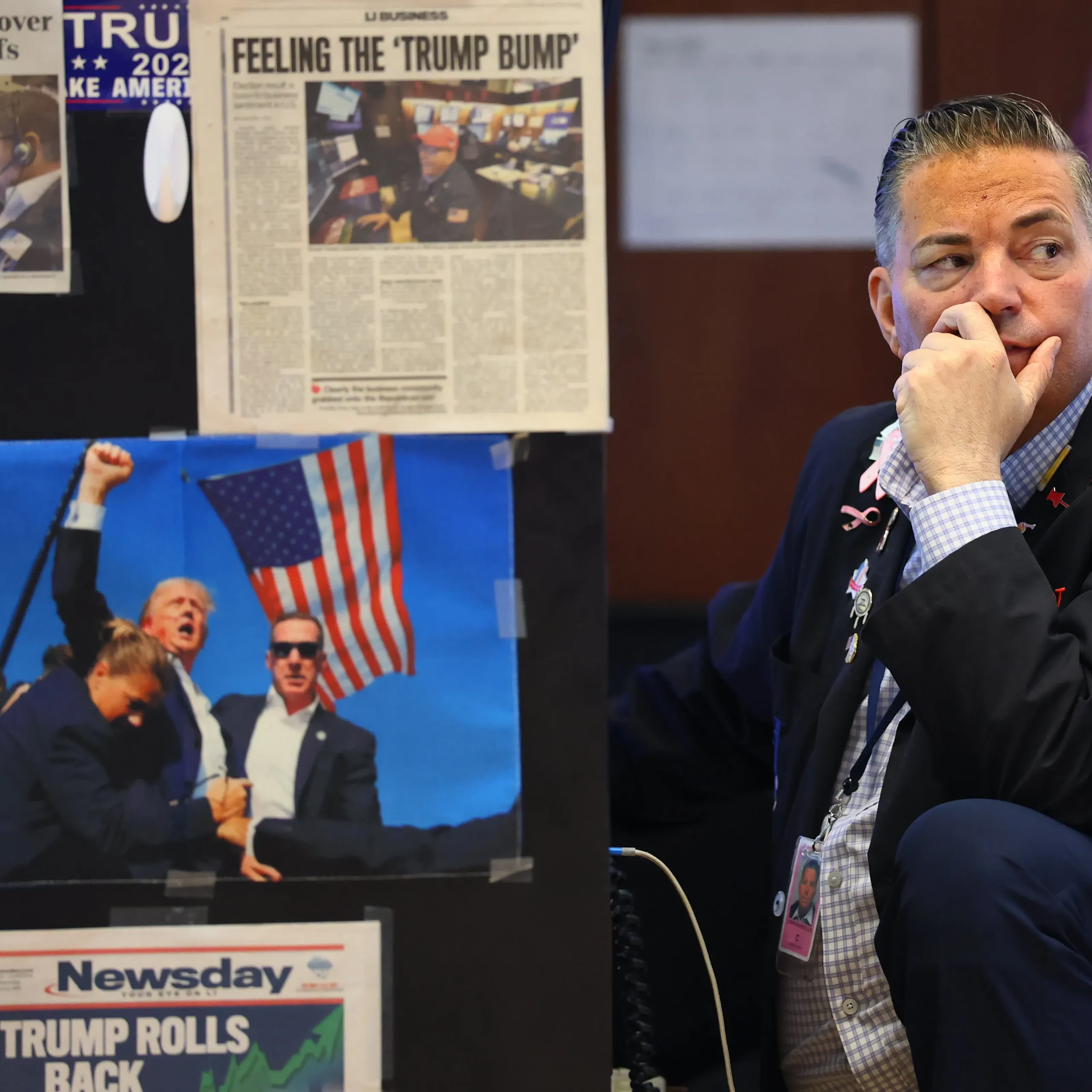

Tesla stock (TSLA). O), opens new tab, fell a staggering 14 percent overnight to wipe out $150 billion in market value, and then bounced 0 points 8 percent in after-hours trading. Trump’s threat to revoke government contracts to Elon Musk’s businesses followed the deterioration of their once-close relationship into a sour public dispute.

Trump told Politico that “it’s okay” when questioned about the relationship and that White House aides had arranged a call with Musk on Friday to try to mediate a settlement, which were indications that tensions might be easing a little.

The losses in European stock futures decreased, with EUROSTOXX 50 futures down just 0.1 percent, while Nasdaq futures increased 0.3 percent and SandP 500 futures gained 0.4 percent.

Outside of Japan, MSCI’s most comprehensive index of Asia-Pacific stocks (. MIAPJ0000PUS), opens a new tab, fell 0.2 percent on Friday from its peak of eight months. A weekly increase of 2.1 percent is still anticipated.

blue chips from China. CSI300), Hong Kong’s Hang Seng opened a new tab that eased 0.2 percent. As a call between Trump and Chinese President Xi Jinping provided little clarity to ease ongoing trade tensions, the opening new tab fell 0.5 percent.

According to Luke Yeaman, chief economist at the Commonwealth Bank of Australia, “I think the fact that they are talking, the fact that there is a willingness to find a way through, and the channels of communication are open is a positive.”.

There isn’t much goodwill to work with to essentially improve the trade relationship, though, and it’s evident that there are still a lot of tensions in the relationship and that neither side wants to give too much away. “..”.

While most Asian stocks have experienced a slight decline, Japan’s Nikkei (. A rare bright spot in Asia, N225, opens a new tab, up 0.4 percent, which helps reduce its weekly decline to 0.7 percent.

AWAIT PAYROLLS.

Expectations for the payrolls report have been tempered by weaker-than-expected labor market data, such as a 47 percent year-over-year increase in Challenger layoffs and a notable negative surprise in ADP’s private payrolls.

In May, 130,000 new jobs are expected to be added, while the unemployment rate remains at 4.2 percent.

The next U could come from any sudden weakness. A. rate cut forward, which led to a massive increase in Treasury bonds. Futures indicate that there is little chance of a rate cut until September, when it is roughly 93% priced in, and that another action is probably in store for December.

After rising three basis points overnight to recover from a one-month low, benchmark ten-year Treasury yields were flat at 4point 3887 percent.

“We anticipate payrolls to lose further momentum in May, printing a below-consensus 110,000,” TD Securities analysts wrote in a client note.

“In recent weeks, markets have been primarily focused on tariffs and deficits, with macro taking a backseat. Although our prediction might not be enough to spark this renewed emphasis on macro, we anticipate that negative surprises will cause a more significant market response. “.

With weak economic data hurting the U.S. dollar, the dollar was 0.2 percent higher against its major peers on Friday, barely above a six-week low. S. cash.

After the European Central Bank lowered interest rates but indicated that it was nearing the end of its year-long policy easing cycle, the euro overnight reached a six-week high of $1.1495. Investors have abandoned a July move, and October or December will probably see the last move.

Oil prices in commodities markets were marginally down, but they were expected to rise every week due to supply issues. U. A. Crude futures were up 3 points for the week, but fell 0 points to $63 points a barrel.

Gold’s price increased 0.4 percent to $3,366.78 an ounce in the precious metals market. They are up 2 to 3 percent for the week.

Editing by Sam Holmes.