Even as the Paramount special committee passed on the offer from David Ellison’s company May 4, sources say the Skydance-RedBird alliance has not given up.

Also quoted in that FT piece was Endeavor and TKO’s Ari Emanuel, who said Ellison is “a natural acquirer” of the company.

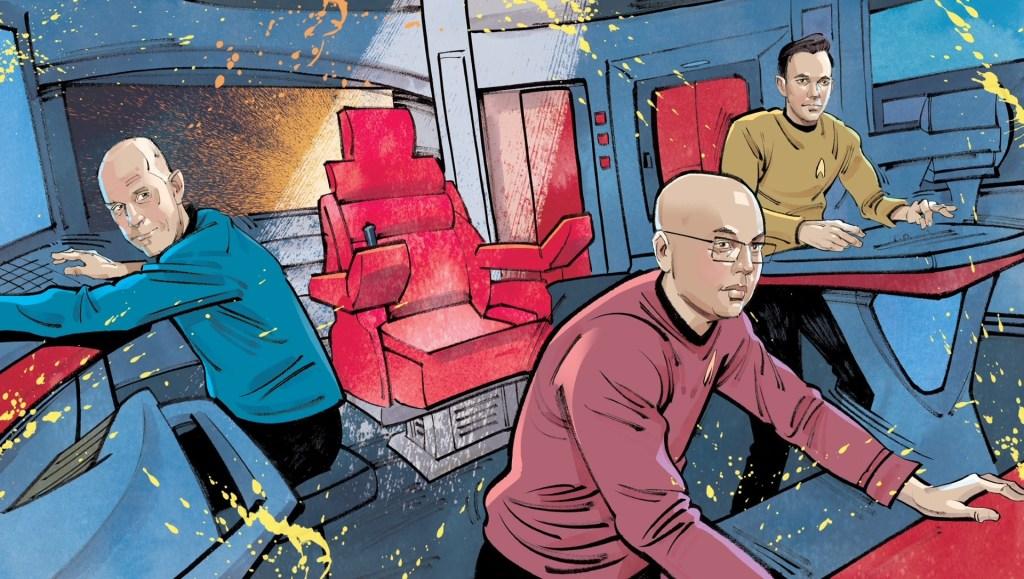

(Ellison is an investor in Paramount franchises including Mission: Impossible, Star Trek, Transformers and Top Gun but doesn’t own any of them.)

What they do with Paramount+ and all that other stuff I think will be refreshing.” Neither the FT nor Reuters noted a detail that seems relevant: Emanuel represents Ellison.

And it’s assumed that if Apollo and Sony Pictures prevail with their rival $26 billion offer, Paramount will essentially vanish.

As for Emanuel’s May 5 comment that Ellison has great relationships with everyone in town, that seems to be an exaggeration.

He has often irked Paramount’s film studio leadership over a variety of matters, including claiming credit for Paramount hits that Skydance helped finance.

Such a vote of no confidence could hardly have landed pleasantly with the remaining Paramount shareholders.

Which celebrities have endorsed Skydance’s plan to acquire Paramount Global’s parent company, National Amusements Inc., will one day be one of Hollywood Trivial Pursuit’s hot topics, regardless of what happens to Paramount Global after the smoke clears. and those that didn’t.

Sources claim that the Skydance-RedBird alliance is still going strong even after the Paramount special committee rejected David Ellison’s company’s offer on May 4. Skydance is still in the wings, and the rival Apollo/Sony Pictures offer, which is currently under consideration by Paramount, is expected to fail for a number of reasons, according to a source with knowledge of the situation who spoke with The Hollywood Reporter.

Therefore, “Skydance has been on an extremely aggressive PR campaign in the last month to convince everyone how legitimate they are,” says a well-known media mogul, in spite of widespread Wall Street skepticism over a proposed deal that favors controlling shareholder Shari Redstone over other investors.

Jim Cameron, who expressed his admiration for the deal to the Financial Times on May 5, appears to have been a success for the company. Other characters have proven more elusive, such as Taylor Sheridan from the Yellowstone universe. Given his extensive and close relationship with Paramount, you can bet that Tom Cruise was also asked for support, but he has remained silent. While a representative for Sheridan disputes the incident, one for Cruise declined to comment.

Ellison is “a natural acquirer” of the company, according to Endeavor and TKO’s Ari Emanuel, who was also quoted in that FT article. “David has big franchises and a real movie business,” he remarked. Although she does not own any of the Paramount properties, including Transformers, Top Gun, Star Trek, and Mission: Impossible, Allison is an investor in them. “Everyone does business with him—Disney, Amazon, Netflix, Apple, and Paramount all have positive relationships with David. In a previous interview with Reuters on April 23, Emanuel stated: “One of the things that people are underestimating is [Ellison’s] sense of tech, compared to some of the other guys… maybe with his father’s help or just his upbringing.”. I think it will be refreshing what they do with Paramount+ and all that other stuff. “.

A seemingly important detail that was overlooked by both the FT and Reuters is that Emanuel is Ellison’s representative. Emanuel’s backing doesn’t offer Redstone much of a fig leaf if she decides to revisit the Skydance deal, given the various reasons he has to see it through. Recall that this same Ari stated to a Bloomberg panel in October 2023, just a few months prior, that although he believed Warner Bros. “I wouldn’t put my money on Paramount,” said the person who believes that Disney and Discovery will overcome their current difficulties. “).

Although not many celebrities have endorsed Skydance, the loss of another big studio and content purchaser after Fox merged with Disney is something that no one in the industry wants to experience. And if rival bids of $26 billion succeed from Apollo and Sony Pictures, it is expected that Paramount will virtually disappear. This explains why Bryan Lourd of CAA also came forward, telling Reuters on April 23 that Ellison would be “an owner-operator that actually loves film and television and stories, and that is needed now more than ever” if he could close the Paramount deal. Who doesn’t love love? It’s not exactly a disagreement from a business perspective, but Lord has refrained from saying anything more. ).

While little is known about what Skydance would do with Paramount’s failing cable channels and money-guzzling streamer, Cameron is clearly infatuated with the concept as well, telling the FT that he loves “the Ellison idea.”. Jeffrey Katzenberg was another to weigh in, telling the audience at the Axios BFD Talks: Los Angeles on May 6 that a Skydance deal would be “a great win for Paramount and for people in the industry.”. It’s probably not going to convince Paramount investors.

The other message emanating from the Ellison alliance is that the three men leading Paramount Pictures—Brian Robbins, Chris McCarthy, the head of Showtime/MTV Entertainment Studios, and George Cheeks, the CEO of CBS—are already at odds with one another. These men are running Paramount as co-CEOs, whether temporarily or permanently. People close to that team angrily refute that assertion.

Regarding Emanuel’s May 5 remark, which seemed to be an exaggeration, it seems that Ellison has excellent relationships with everyone in the town. He has frequently irritated the management of Paramount’s film studio over a range of issues, such as taking credit for Paramount hits that Skydance assisted in financing.

On May 4, Oracle of Omaha Warren Buffett announced that he had sold his entire stake in Paramount at his company’s annual meeting. Buffett became the company’s largest shareholder in May 2022 after making an initial investment of $2.66 billion. At that time, he held non-voting shares, as Redstone and NAI retained voting control. Buffett stated, “We lost a good deal of money when we sold it all.”. The remaining Paramount shareholders could hardly have taken kindly to such a vote of no confidence.

The situation was made worse by Buffett’s remarks, which were extremely ominous for anyone trying to maintain a legacy media company and reflected his misgivings about the streaming wars that have cost Paramount and other studios significantly. He declared, “I definitely looked more closely at the whole issue of what people do for fun and what the rules are for managing any kind of entertainment company, be it movies, sports, or anything else. “I believe that I have learned more in the past few years than I did, but I also believe that I have become poorer as a result of the way I learned it. “.

This report included contributions from Alex Weprin.