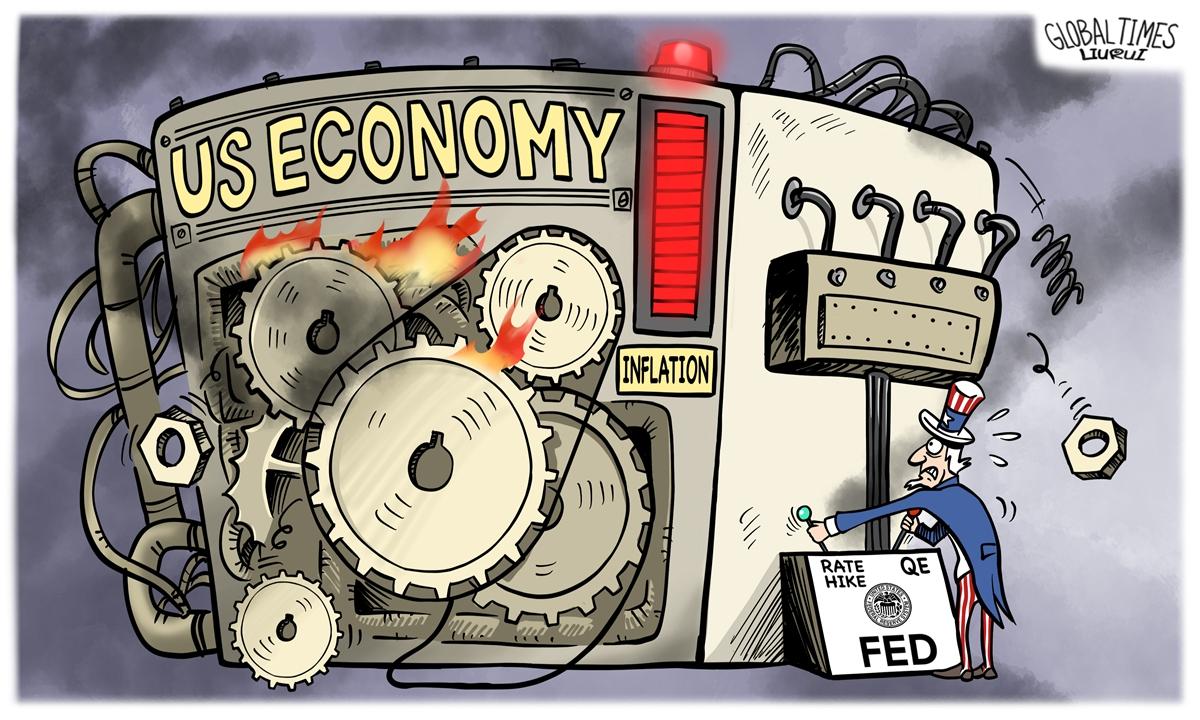

US economy Illustration: Liu Rui/GT One year after the collapse of Silicon Valley Bank and several other US lenders, another regional bank has crumbled, reigniting concerns about the adverse impact of the US Federal Reserve’s monetary tightening.

For instance, PNC Financial and M&T Bank recently reported double-digit profit declines in the first three months this year as higher interest rates eat into their profits.

If anything, the plight faced by regional US banks is a microcosm of the negative impact the Fed’s tightening policy has brought to the country’s financial market.

The Fed’s high interest rate policy is supposed to tame inflation and maintain economic stability, but it has proven to be ineffective for those purposes.

Now with US inflation exceeding expectations for a third month in a row, hopes for a rate cut in the short term have been dashed, highlighting the dilemma of the Fed’s policy choices.

Meanwhile, the negative spillover effect of the Fed’s high interest rates on the global economy and capital markets is bound to accumulate and worsen.

The depreciation of these currencies has also sparked turmoil in stock markets in some countries, evoking ugly memories of the 1997 Asian financial crisis.

The impact of the strong dollar on Asian markets is a complicated issue, encompassing monetary policy, international trade and capital flows, among other factors.

Figure: US economy / Liu Rui/GT.

Another regional bank failed one year after Silicon Valley Bank and several other US lenders failed, raising new worries about the unfavorable effects of the US Federal Reserve’s monetary tightening.

In an effort to “protect depositors,” US regulators seized Republic First Bancorp and decided to sell it to Fulton Bank, which will buy all of the distressed lender’s assets and accept nearly all of its deposits, according to a report published by Reuters on Saturday.

Despite Republic First Bancorp’s relatively small size, its abrupt demise could serve as a warning that, despite the previous year’s wave of bank failures, the US regional bank crisis might still be far from resolved—that is, provided the Federal Reserve keeps its policy rates high, between five and five-and-a-half percent.

One bank that has been feeling the brunt of ongoing high interest rates and rapidly declining values on commercial real estate loans is Republic First Bancorp. For example, as higher interest rates eat into their profits, PNC Financial and MandT Bank recently reported double-digit profit declines in the first three months of this year.

In a way, the predicament of local US banks represents the detrimental effects that the Fed’s tightening strategy has had on the nation’s financial system. While maintaining economic stability and controlling inflation are the stated goals of the Fed’s high interest rate policy, these goals have not been met. Now that US inflation has surpassed forecasts for a third consecutive month, expectations of a short-term rate cut have been shattered, underscoring the quandary surrounding the Fed’s policy decisions. The Fed appears to be clueless about how to handle the complex situation, which is even more concerning.

In the meantime, the adverse effects of the Fed’s high interest rates on the capital markets and the world economy will inevitably compound and get worse. The longer the US economy is held back by the Fed’s high interest rate policy, the more pressure it will put on the domestic financial system as well as the international financial markets, especially the emerging markets.

The emerging market economies face challenges in a high-rate environment, including capital flight pressure, higher foreign debt servicing costs, and a higher risk of currency depreciation.

For instance, there have been increasing signs of currency war since the middle of April due to the increasing volatility of the currencies of many Asian economies. The devaluation of these currencies has also caused unrest in certain nations’ stock markets, bringing back painful memories of the Asian financial crisis of 1997.

From China’s standpoint, even though the yuan has proven to be resilient in the foreign exchange market recently, China must keep a careful eye on how US monetary policy affects larger Asian markets. Strong dollar strength has a complex effect on Asian markets that involves capital flows, international trade, and monetary policy, among other things.

China needs to actively participate in regional and international cooperation to safeguard its financial and economic security and be ready with practical steps to strengthen its own financial risk management system in the event that another dire situation arises in Asia.

China can counteract the effects of external shocks on its economy by using a variety of policy tools, such as enacting a cautious fiscal policy, responding quickly to external shocks by adjusting monetary policy, and using a range of measures, including reserve requirements and interest rate adjustments, to maintain financial market stability with the backing of the central bank.

As part of multilateral mechanisms like the G20 and APEC, China could also enhance international dialogue and coordination with other nations and regions. This would allow for joint policy coordination, risk management, and the protection of the stability of the global financial market.