Staffing shortages have forced the U.S. federal government to scale back the price checks it uses to calculate the inflation rate.

The agency suspended data gathering altogether in Lincoln, Neb., and Provo, Utah in April and halted it in Buffalo, N.Y., this month.

Government making educated guesses on prices of more goods The cutbacks come as economists are on the lookout for signs that Trump’s tariffs could rekindle inflation.

For the April inflation report, which was published last month, the government was forced to make educated guesses about more prices than usual, using the price of similar items, said Omair Sharif who tracks the data for Inflation Insights.

“The federal government hiring freeze and the drive to cut funding across federal agencies may be starting to impact the quality of economic data,” Sharif wrote in an email.

Due to a lack of employees, the U. A. federal government to reduce the number of price checks it employs to determine the rate of inflation. Economists caution that this might result in reports on cost of living that are less accurate.

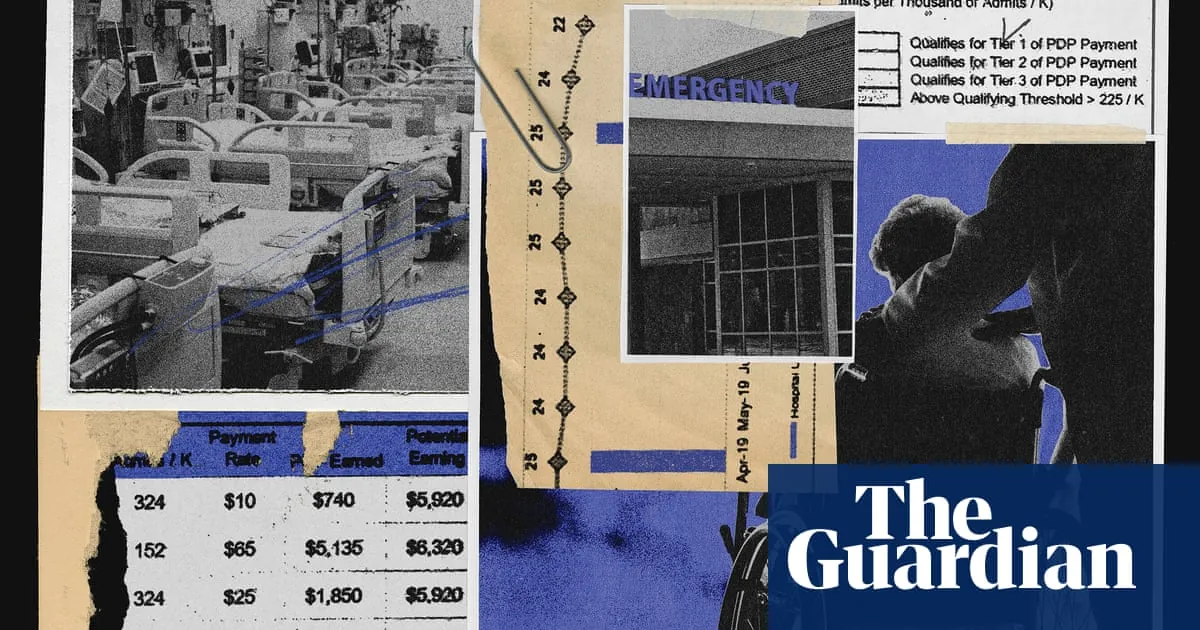

The consumer price index, also known as the CPI, is a measure of inflation that is calculated each month by hundreds of government workers who look up the prices of goods and services in cities across the nation.

The Labor Department announced this week that it had reduced price checks across the country and suspended them completely in some cities due to a shortage of workers.

In Lincoln, Nebraska, the agency completely stopped collecting data. stopped it in Buffalo, N.C., and Provo, Utah in April. Y. in this month.

hiring freeze by the federal government.

In a statement, the Bureau of Labor Statistics stated that it “makes reductions when current resources can no longer support the collection effort.”. “.

Since President Trump took office, hiring at the federal government has been suspended. The Labor Department’s own count indicates that 26,000 federal employees have been let go since January, though it’s not entirely clear how big the cuts actually are.

The department stated that it anticipates the decreased data collection to have “minimal impact” on the overall rate of inflation, but cautioned that it may increase volatility in regional cost-of-living reports or price data for specific items.

The government is making educated guesses about higher goods’ prices.

The reductions occur as analysts watch for indications that Trump’s tariffs may spark inflation again.

Yale Budget Lab economist Ernie Tedeschi posted on social media, saying, “This is the worst possible time to make staffing cuts to the CPI of all data sources.”.

“Remember that a decrease in staffing does not always translate into a lower CPI; an excessively high CPI could also be the mistake, which is also undesirable. Tedeschi, a member of the Biden administration’s Council of Economic Advisers, wrote, “As we attempt to navigate the uncertainty, we want accuracy.”.

According to Omair Sharif, who monitors the data for Inflation Insights, the government was compelled to make educated guesses about a greater number of prices than usual for the April inflation report, which was released last month.

Sharif wrote in an email that “the federal government’s hiring freeze and the push to reduce funding across federal agencies may be starting to impact the quality of economic data.”.

Americans are affected by inflation figures in numerous other ways. As it determines interest rates, which impact the cost of borrowing for families and businesses, the Federal Reserve keeps a careful eye on them. Additionally, they are used to adjust government programs like Social Security for cost of living changes.

According to Sharif, “it’s not a stretch to say that they affect the lives of everyday folks.”. Degrading these statistics’ quality only makes the economic results of the future worse. “..”.